Working document n ° 855: the central bank, the treasure or the market: which determines the price level?

This document describes the game played by a budgetary authority aimed at spending as much as it can and a monetary authority targeting a certain price level trajectory.The link between the two authorities is that the two authorities do not like, to a certain extent, the sovereign defect.The objective of this working document is to determine the conditions according to which an authority imposes its views on the other authority.This non -technical summary describes the main results of the article.

We study a two -dates game that we then extend to several dates.In relation to the literature, we assume that the budgetary and monetary authorities cannot engage in future policies.The monetary authority issues reservations, fixes interest rates and can use part of the product to buy the obligations issued by the government.The budgetary authority issues debts, can be lacking on past debts and consumes.Price level is the price of goods in terms of reserves.

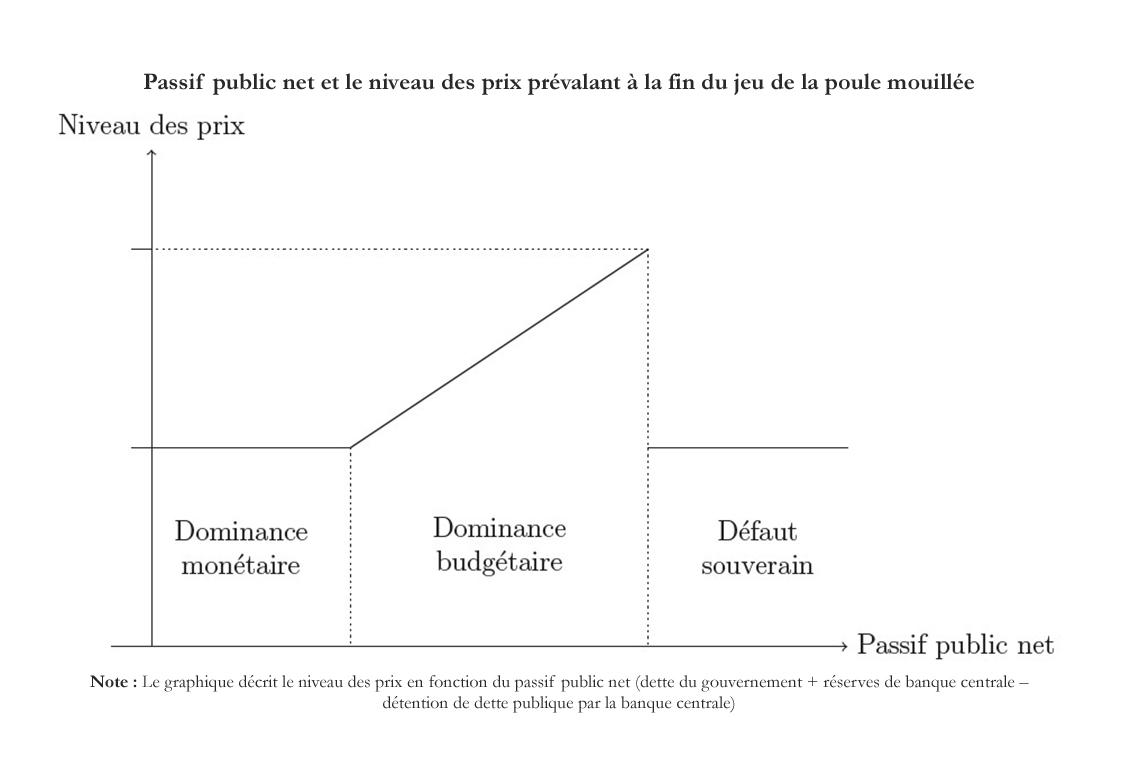

Price level may depend on net public liabilities.We call on a dominance budgetary the situation in which the budgetary authority imposes its views on the monetary authority - when the monetary authority deviates from its objective of price stability to ensure the sustainability of the debt.Our first result is that at the end of the game, budgetary dominance prevails when the public liabilities in the hands of the private sector exceeds real public resources.When the public net liabilities are sufficiently low, monetary dominance prevails.Finally, when it is so high that the price level required to make sustainable debt exceeds what monetary authority is ready to tolerate to avoid lack of payment, the monetary authority prefers to let the government be lacking.The figure below shows the relationship between the price level on the terminal date and the public passive net.

Budget dominance only appears when all budgetary capacities are exhausted.If the government cannot engage, unlike Sargent and Wallace (1981), the central bank can resist and avoid budgetary dominance until the budgetary authority can increase its income.Thus, budgetary dominance, like that of the central region of the above figure, occurs when the public net liabilities go beyond the real resources of the public sector multiplied by the price objective of the Bank.In this case, the central bank deviates from its objective and takes any necessary measure to obtain the minimum price level which ensures the sustainability of the debt.Budgetary dominance therefore requires that the budgetary authority no longer has a budgetary space.

The exhaustion of budgetary capacity can be expensive for the budgetary authority: this requires distributing spending over time in a specific manner (possibly sub-optimal) and this leaves little margin to absorb new macroeconomic shocks.The article explores only the first type of cost.When she chooses her optimal debt emission policy, the budgetary authority must therefore arbitrate between the cost of the surender and the potential gains in inflation.The budgetary authority will not deliberately choose budgetary dominance if the allocation costs dominate the gains linked to inflation.The article shows that this is the case when the nominal liabilities inherited from the past is low, that the budgetary authority is sufficiently patient, that future budgetary resources are significant and that real rates are sensitive to the level of public debt.

How can monetary authority alleviate the cost of budgetary dominance?When the debt inherited from the past is enormous, fiscal domination is inevitable because real resources are insufficient to repay the debt inherited from the past with prices in accordance with the objective.In some cases, the monetary authority can then mitigate the cost of budgetary domination by moderately increasing inflation preventively.In doing so, the monetary authority reduces the incentives of the budgetary authority to engage in a strategy of budgetary domination.

When the debt is reimbursed by itself due to a dynamic ineffectiveness.In this case, part of the public debt may not be covered by future primary surpluses.This part is fragile, however, and depends on self-realizing beliefs on the future private request for public debt.In such a context, the private sector can die the bubble if it is disappointed by certain decisions of the public sector, granting it an exorbitant privilege.In such an environment, the private sector, through output threats, determines who wins the game of the wet hen leading to what we call the dominance of the.Budget and monetary dominance can prevail depending on the off -balance strategy in the private sector.

![PAU - [ Altern@tives-P@loises ] PAU - [ Altern@tives-P@loises ]](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/179/2022-3-2/21584.jpeg)

![Good deal: 15% bonus credit on App Store cards of €25 and more [completed] 🆕 | iGeneration Good deal: 15% bonus credit on App Store cards of €25 and more [completed] 🆕 | iGeneration](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/179/2022-3-2/21870.jpeg)

Related Articles