Understand the functioning of factoring

Businesseby Kévinwritten by KévinFactping is a solution thanks to which companies can finance their cash needs without calling for a conventional loan.This financing technique, which is based on the sale of customer receivables to a financial organization, offers several advantages.Companies in various activity sectors already take advantage of this system to quickly have funds.Why not you ?To help you in this process, we explain how to work on factoring.

Factping: What is it?

Also known as factoring, factoring is a funding method that companies can use, in order to meet their cash needs.Based on the sale of customer receivables to a factor, which is a financial institution, this solution allows you to quickly have funds.In other words, this technique operates invoices to the financial organization.In return, he compensates for the cash flow needs of the factories by providing him with the necessary sums.

If you favor this option as a professional, you reduce your payment deadlines while gaining efficiency.You can therefore focus on the heart of your profession and thus boost your business.Comparators as factoring.fr help you find financial institutions that offer you offers up to your expectations.In terms of factoring, the funding you can get is scalable and adapted to your specific cash needs.This is why you must always compare the different contract proposals via a comparator in order to make a good choice.

What is the principle of factoring?

Factping is a system in which a financial institution aims to make available to a company the funds emanating from its invoices.For the factories, it is therefore not necessary to wait for the payment deadlines.Thanks to this mechanism, the professional is immune to operating problems due to cash offsets.For its part, the Factor takes care of everything related to the administrative management of the invoice:

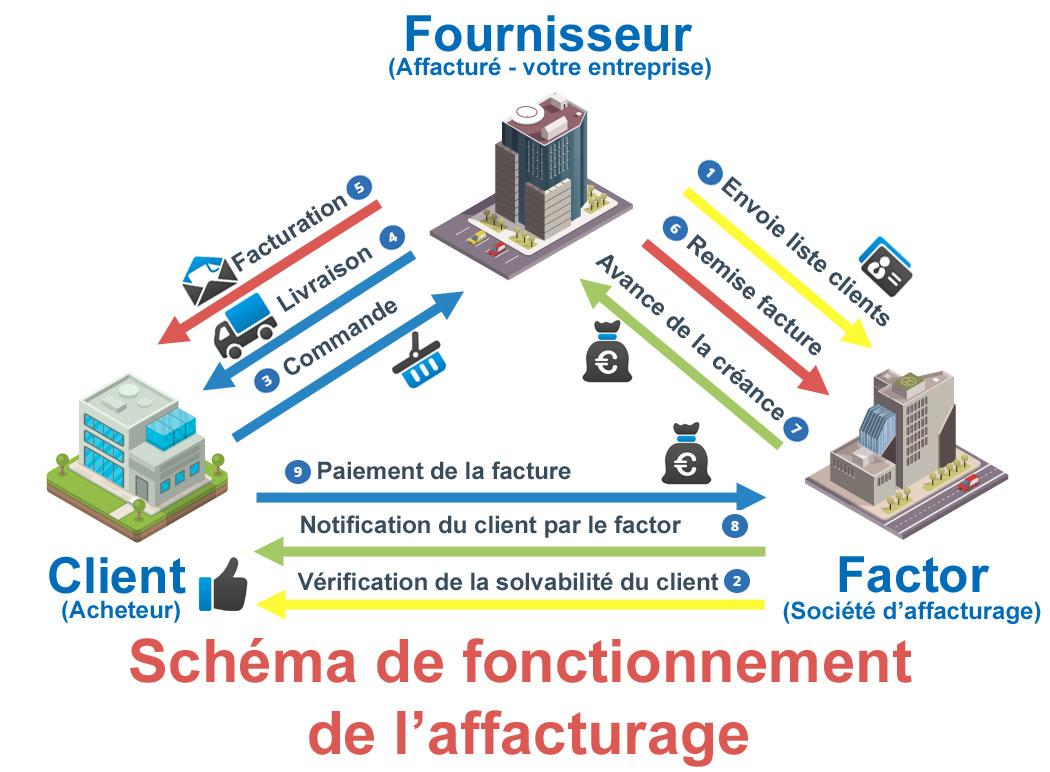

It should be noted that, from a legal point of view, the organization funds, by the process of the transfer of ownership, the risk of the recovery of the invoices of the failed company.This means that if you are the rewarding company, these accounting documents no longer belong to you.They are now in the hands of the factor.You therefore take out the concerned customer invoices of your assessment to transform them into cash flow.The structure that requests the financial institution gives him the list of his customers.The latter ensures the solvency of each of them and attributes a notation according to which it gives its approval.

How does a factoring contract work?

When you ask the services of a factor, you must comply with the factoring contract which is established between you.This fixes the rules for the delivery of your customer invoices to the financial institution.There are different types of factoring contracts that meet the particular needs of each professional.

The managed factoring contract

If this type of factoring contract is established between the parties, the management of customer positions is entrusted to the financial organization.He therefore takes care of the recovery of the payment of invoices, either by phone or in writing.It is the Factor that takes care of cash payments in the case of a managed factoring contract.

The factoring contract without recourse

In the case of this solution, unpaids remain the responsibility of the company.However, she continues to have a master's degree in her receivables.

The unhappy factoring contract

With the non -notified factoring contract, no mention appears on customer invoices.Which implies that the payment of these is made for the benefit of the factory company.

The factoring contract with appeal

In this option, a guarantee against unpaids is provided for by the company of Factoring.The company benefits from compensation up to 100 % of the amount of claims.

The notified factoring contract

This type of factoring contract contains a subrogation mention for the benefit of the financing establishment.With this indication of customer invoices, payment is made for the benefit of the factor.

The unmanaged factoring contract

It is set up for a company that wishes to keep the management of the customer position.In this case, the company of Factoring allows it to take care of the recovery of the invoices submitted.

Depending on your cash needs and the control you want to keep on the management of invoices, there are therefore different factoring contracts.Take the time to compare the offers proposed by financial organizations to find the right company of Factoring.

0 comment1FacebookTwitterPinterestEmailKévin

I work at the Human Resources pole of a company with more than 200 employees!Management, it knows me :)

previous postCompanies in Occitanie: the question of recycling des déchets

next postComment développer son investissement stratégique

related posts

SCCT training: main assets for a company

Agec law in 2022, what impact on...

Management presence: Description and benefits for visibility...

Why use the services of a Growth Agency...

Optimizing your organization: Advantages of ink pads

Save with an electricity comparator for...

Teaching training: how to train your employees?

How does the annualization of working time work?

Companies in Occitanie: the question of recycling...

Quality Teambuilding thanks to a specialist...

Leave a Comment Cancel Reply

Save my name, email, and website in this browser for the next time i comment.

![PAU - [ Altern@tives-P@loises ] PAU - [ Altern@tives-P@loises ]](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/179/2022-3-2/21584.jpeg)

![Good deal: 15% bonus credit on App Store cards of €25 and more [completed] 🆕 | iGeneration Good deal: 15% bonus credit on App Store cards of €25 and more [completed] 🆕 | iGeneration](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/179/2022-3-2/21870.jpeg)

Related Articles