October markets and red |The press

If the temperature allows, many city dwellers will want to take advantage of the weekend to take the countryside in order to go to contemplate the traditional and always as fascinating changing October when our forests drape itself in red before undressing completelyFor their long hibernation.October is a bewitching month, but it is much less so when it is the stock lessons that go from green to red.

Publié le 2 oct. 2021If I allow myself today to make this correlation between the fall beauty of nature in October and the risks of a sudden discoloration of the markets, it is that the month of October is inseparably linked to the memorable stock market krachs of 1929 and1987.

Rest assured, these two spectacular events, which have forever marked the spirits, are not about to reproduce, but the fact remains that we always approach the month of October with a certain apprehension.

However, historically, the month of October is not worse than the others in terms of product yields, but it is a month when there is greater market volatility.

And this is why it will be interesting to see how they will behave, especially the North American markets, in the coming days, since their clues have just taken their worst monthly performance of the last year.

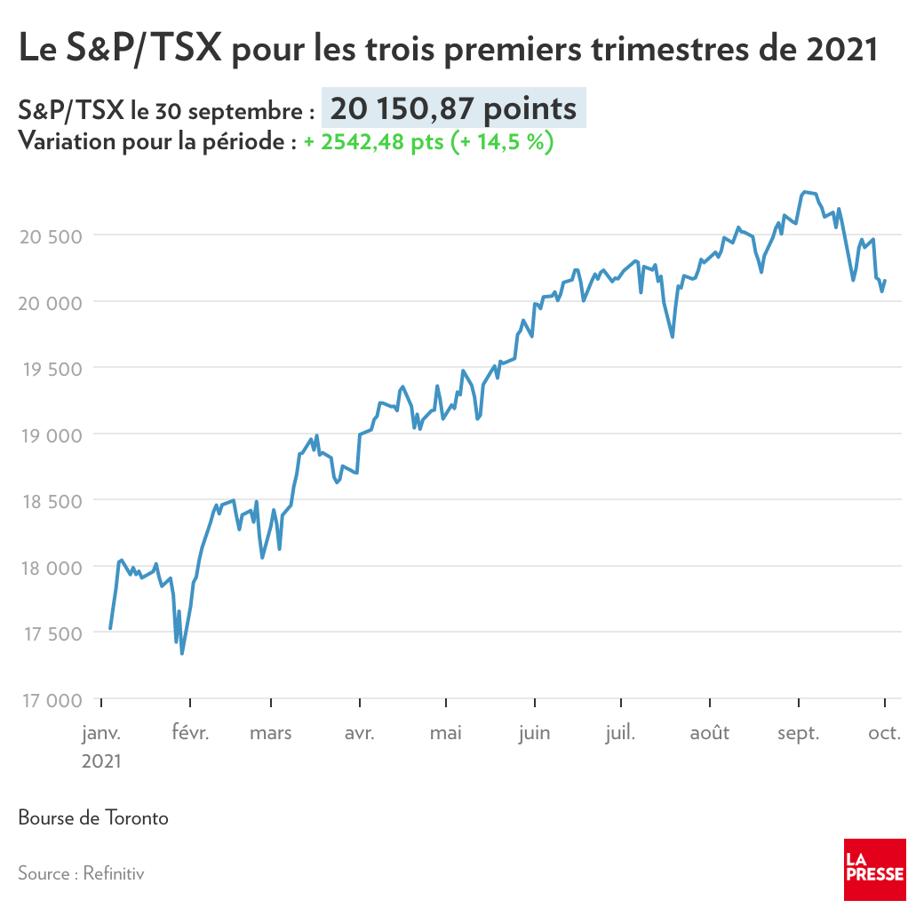

En septembre, les indices Dow Jones, S&P 500 et NASDAQ ont respectivement reculé de 4,2 %, 4,7 % et 5,3 %. L’indice S&P/TSX de la Bourse de Toronto a pour sa part subi une dévaluation mensuelle moindre de 2,9 %.

Despite these setbacks, it should be remembered that the four North American indices still posted yields over 30 % on September 30 in the last 12 months, especially 29 % for the NASDAQ and 24.4 % for the TSX.

Pour l’indice S&P 500, il s’agissait du premier mois de repli en sept mois, tandis que l’indice Dow Jones vient d’afficher un premier recul trimestriel depuis la forte chute boursière du premier trimestre de 2020, lorsque la pandémie a tout ravagé sur son passage.

Overheating indicators

This September stock market disappointment is largely attributable to the fears of a possible outbreak of inflation, to the possible repercussions of the bankruptcy of the Chinese giant Evergrande and to the debate surrounding the deployment of the debt of the United States, reminds us of the bankNational in his last market review.

All these elements distill uncertainty among investors, we understand it well, but there are other factors that tend to demonstrate that the pot begins to overheat.

The price of oil is at its highest level of the last five years.At a time when we only hear about the urgency of decarboning the economy, the price of American oil is found above the US $ 75 per barrel, while it was at $ 41 USA year ago, and at US $ 33 in April 2020.

The prices of aluminum and nickel are another fine example of a point damage.Two weeks ago, the ton of nickel crossed the brand of US $ 20,000, a summit since 2014, while the ton of aluminum has passed the US $ 3,000 mark to fold up for US $ 2,850,What remains of the prizes never seen since 2008, the border year of the great global recession of 2009.

Little historical reminder. Durant l’effondrement boursier de 2008, qui s’est étalé sur quatre mois, de septembre à décembre, c’est en octobre que la Bourse américaine a enregistré sa plus forte chute avec une baisse de 14,5 % de l’indice S&P 500, qui a perdu 37 % de sa valeur au total.

What complicates the current situation and does not facilitate reading what we reserve in the coming months of post-chew pandemic economic recovery is how far the scope of governments can go.

We see him in the United States, President Biden struggles to make his own party plan accepted within his own party plan of several thousand billions of dollars.

It's a lot of money and we request the print machine of green tickets as never before we have done before.This massive injection of capital in the economy will invariably generate inflation and have repercussions on the purchasing power of American consumers, the engines of economic growth in the United States.

The American government must be understood by October 18 to allow the increase in the American debt ceiling.In the meantime, it will be interesting to follow the evolution of the markets and their perception of what the future has in store for us.

![PAU - [ Altern@tives-P@loises ] PAU - [ Altern@tives-P@loises ]](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/179/2022-3-2/21584.jpeg)

![Good deal: 15% bonus credit on App Store cards of €25 and more [completed] 🆕 | iGeneration Good deal: 15% bonus credit on App Store cards of €25 and more [completed] 🆕 | iGeneration](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/179/2022-3-2/21870.jpeg)

Related Articles