Life insurance: how the savers are relieved of part of their return

Statistics almost went unnoticed.And yet, this is essential information for holders of a life insurance contract.In 2020, provisions for profits in profits (PPB) increased again, to go from 4.7% to 5.1%, according to the latest data from the Prudential Control and Resolution Authority (ACPR).With this increase - the 9th consecutive -, the reserves provisioned by insurers on euros funds of life insurance contracts now represent no less than "4 years full of revaluation", according to the insurance gendarme.While the profits put aside by insurers have further inflated, the performance of the guaranteed capital support for life insurance has, at the same time, continued to crumble, to go from 1.46% in 2019 to 1, 28% a year later.Four years of yield “sleep” therefore in the PPB made up of insurers.And soon five probably, the remuneration of the Euros fund being called to break the floor of 1% in 2021, according to the projections of the good value for money..

>> Notre service - Testez notre comparateur d’Assurances vie

PPB, an effective mechanism in the past...

The reserves accumulated by insurers therefore have something to surprise, the latter coming considerably to engrave the performance served for savers on the Euros fund, already flush with the Pâquerettes.But they are not illegal: "The provision for participation in profits is defined by the insurance code", recalls Franck Le Vallois, director general of the French Insurance Federation (FFA).Admittedly, the insurer must, each year, transfer to the Euros fund a "participation in profits".A return which corresponds to at least 85% of financial profits (yields of workers in portfolio) and to 90% of technical profits (the difference between the costs invoiced and the real costs).But it has a room for maneuver since this return can either be, completely and directly, integrated into the remuneration of the Euros fund, or be partly assigned to a reserve account, the famous “Provision for participation in profits” (PPB)).He must then redistribute this return within the legal period."One euro put in PPB by the insurer must be redistributed at the latest within 8 years.This money therefore belongs to the insured ", supports Franck Le Vallois, who wants to" avoid suggesting that when the insurer endowed this provision, this money leaves in his pocket ".And the manager to recall that the PPB, which “allows to face bad financial years, by taking all or part of it to smooth the effects on the rate served, is a protective mechanism for the insured”.As proof, the financial crisis of 2007-2008, after which the yield of the Euros fund was maintained at 4% in 2008 and then at 3.6% in 2009, after 4.1% in 2006 and 2007.“In the past, insurers have resumed on their PPB to improve the rates served for insured and prevent savers from being too impacted by unfavorable conditions of market.Before financial crisis (from 2007-2008, editor's note), the provision for participation in profits represented around 2.5% to 3% of outstanding outstanding.In 2011, it had decreased to 1.6%, ”recalls Franck Le Vallois.It is therefore clear that the PPB had perfectly played its role as shock absorber at that time.

>> A lire aussi - Assurance-vie : frais, durée...Our advice to choose the right contract

... but who no longer supports the rates

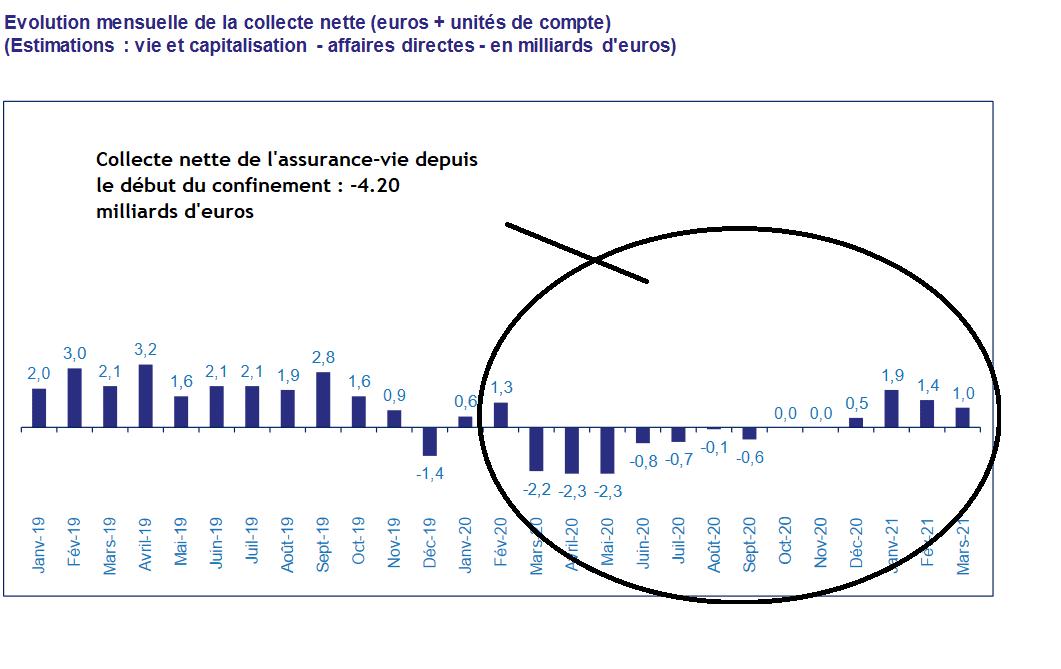

If the leader of the French Insurance Federation insists on the beneficial effect of the PPB for savers, it is for a good reason.Indeed, many market players doubt this good faith displayed.Because the situation has evolved since the last financial crisis, the reserve of insurers having jumped by 1.6% in 2011 to 5.1% 9 years later, all with increases between 0.1 and 0, 6 point per year."Since 2011, the PPB has continued to increase," notes Guillaume Prache, the president of the Federation of Independent Associations for the Defense of Retirement Savers (Faider).If he regrets this tendency to swell the reserves, it is because at the same time, the yields served for savers have considerably bent."The objective of the PPB is to put aside the good years to donate bad.And that's not quite what's going on, "observes the expert.Indeed, even in period of lean cow for the insured, the provisions for provisions for participation in profits were considerable - +0.6 point in 2017 and +0.3 point in 2018 - while the average yield of Euros S'sank at 1.80%."The payments on the PPB have developed a lot, including during the years when the yields of the euros funds were very low, even negative taking into account inflation", challenges Guillaume Prache.Thus, according to the latest Better Finance report, the European Federation of Savings and Users of Financial Services, published in October, the real performance (net of inflation) of the Euros fund, after social security contributions (17.2%), went into red in 2018, at -0.4%, then in 2019 (-0.5%), to return to positive territory in 2020 (+1.1%)...solely favoring consumer prices stagnation.

>> A lire aussi - Assurance vie : fonds euros, immobilier… le bilan des rendements 2020 par Cyrille Chartier-Kastler (Good Value for Money)

Low rates, threat or alibi for insurers?

Arrested on the cross trajectories of the rates served and reservations made up of insurers, Franck Le Vallois insists on the harmful consequences of bond rate rates, which mainly garnish Euros funds.Because after long months in negative territories, the yield of the assimilable bond of the Treasury (OAT) at 10 years only returned to the green a few days ago, at 0.216% on October 20."As long as the rates remain negative, or low, they will tend to cut the yield of the general portfolio of insurers, which will encourage them to remain cautious, anticipates the director general of the French Insurance Federation.And faced with this uncertainty, the insurer must protect the savings from his insured, "he claims.Another threat weighing on the yield of the Euros fund: a possible correction on the financial markets in the coming months.The euros funds being on average composed of 8.63% of shares at the end of 2019, according to Good Value For Money, a dive of the stock market courses would erode - even marginally - again the rate of the guaranteed capital support."In a scenario where financial yields would be negatively impacted by the markets, the provision for participation in profits allows insurers to partially amortize the shock," says Franck Le Vallois.

A message brought for a long time by the governor of the Banque de France and president of the ACPR, François Villeroy de Galhau, who has urged insurers for many years to lower the yield of the Euros fund to stick to the low rates that penalize them.A advice that is not meaningless for Cyrille Chartier-Kastler, founder of the Good Value For Money firm, even in the event of bond rates: “Interest rates, and theinflation, go back to the future.And the PPB is security in relation to this type of possibility."In other words, in the event of the rates, or of raising the latter around 1-1.25%, the yields put in reserve will be able to support the performance of the Euros fund, make it more attractive...And therefore avoid outings on life insurance contracts for the benefit of other more profitable investments, such as regulated savings booklets, booklet A in the lead, which would benefit from the return of inflation inflation.

>> Notre service - Faites des économies en testant notre comparateur de Livrets d’Epargne

Additional room for maneuver for insurers

Admittedly, the behavior of insurers necessarily adapts to the gloomy situation on the rates, but their real motivations should be sought elsewhere, according to Cyrille Chartier-Kastler: “Insurers want to dissuade savers from going to the Euros Fund Euros.This is why they pay part of the financial return in the PPB, "slips the expert.A questioning that the FFA leader clearly refutes, who certifies that reserves “do not constitute a lever to push savers to units of account (UC)”, supports (shares, real estate, etc.) on whichinsured persons carry the risk of capital loss, and no longer insurers as well as on the Euros fund.Another hypothesis carried by Cyrille Chartier-Kastler: insurers would inflate the PPB to improve their prudential ratio.The latter can indeed, since 2019, take into account 70% of these reservations in their solvency margin and thus cover themselves in the event of the lift of bond rates.Hence the temptation "to continue to increase their provisions for participation in profits instead of starting to redistribute them to maintain the purchasing power (returns) of the insured", denounced to Capital Guillaume Prache in September 2020.Same denials still on the side of the French Insurance Federation: “In a hyper competitive market, the competition between products via the rates served on the Euros funds means that insurers do not provide the PPB in order to improve their solvency”, Simply decides Franck Le Vallois.

>> A lire - Assurance vie : les rendements des fonds euros de tous les contrats du marché

2021, “a test year”

As we will have understood: insurers assert a posture of a good father and defend their prudent reserve policy by the risks weighing on Euros funds.But for how long?Guillaume Prache wonders "When the savers will recover the PPB, because the little game can last a long time".“The insurers left to continue”, predicts Cyrille Chartier-Kastler.The reserves could therefore swell this year and the insurers continue to “run the laundry to return the PPB 50 years later”, mischievously adds the founder of the office Good Value for money.

Except that for their part, savers do not have such a long horizon.They should even be in a hurry to recover this providential windfall as soon as possible.Because inflation coupled with the erosion of the remuneration of the guaranteed capital support should, without support from insurers, plunge the actual rate served for 2021: “The average of the Euros Fund yields may be less than 1% andInflation close to 3% (+2.2% in September, editor's note), warns Guillaume Prache.2021 is very likely to be the worst year of funds in euros for savers and will therefore be a test year to see if the PPB will be used to compensate a little, or a lot, the real loss.”The savers will be set in a few months, the first yields being communicated by insurers next January.

>> A lire aussi - Réserve de capitalisation : principe et intérêt

![PAU - [ Altern@tives-P@loises ] PAU - [ Altern@tives-P@loises ]](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/179/2022-3-2/21584.jpeg)

![Good deal: 15% bonus credit on App Store cards of €25 and more [completed] 🆕 | iGeneration Good deal: 15% bonus credit on App Store cards of €25 and more [completed] 🆕 | iGeneration](http://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/179/2022-3-2/21870.jpeg)

Related Articles